What's happening in the market? Guiding Leaders Through a Shifting Mortgage Landscape

March 2022

Straight To The Point

The mortgage market is in a state of transition. Rising interest rates, declining refinance volumes, record home price appreciation (HPA), and policy uncertainty is creating a significant paradigm shift for the industry. This profound disruption can complicate planning and prioritization, as organizations work to maintain profit margins, and may cause new enforcement focus on equitable origination and servicing practices. Reference Point’s team of renowned former C-suite mortgage executives and experienced consultants deliver independent thinking as clients navigate this uncertainty.

Overview

The single-family mortgage market is facing a paradigm shift as it heads into 2022. Recent years have been characterized by low rates, record volumes, and the launch of new entrants with significant technology and capital support. The market in the past 2 years has been the result of an unprecedented response from the Federal Reserve, driving interest rates down in a pandemic to record low levels. The end of the Fed’s market support policies and the expected decrease in refinance volumes may cause a smaller borrower pool, lower margins, increased competition, and unknown equitable compliance requirements. Conversely, record home price appreciation (HPA) may create new opportunities. The course correction of the market and return to “normalcy” will force organizations to address this change with strategic investments of their own.

Trends We’re Watching

| Loan Value Loans are expected to become more expensive to originate than in the historic boom years of 2020-21. |

| Lending Options Purchase money borrowers may experience an increased number of lending options |

| Industry Investments Operational and technology enhancements are expected to increase to address heightened competition |

| Financial Impacts Market conditions may fuel margin compression and increased customer acquisition costs |

Rate Change as a Result of Fed Messaging & Contracting Liquidity

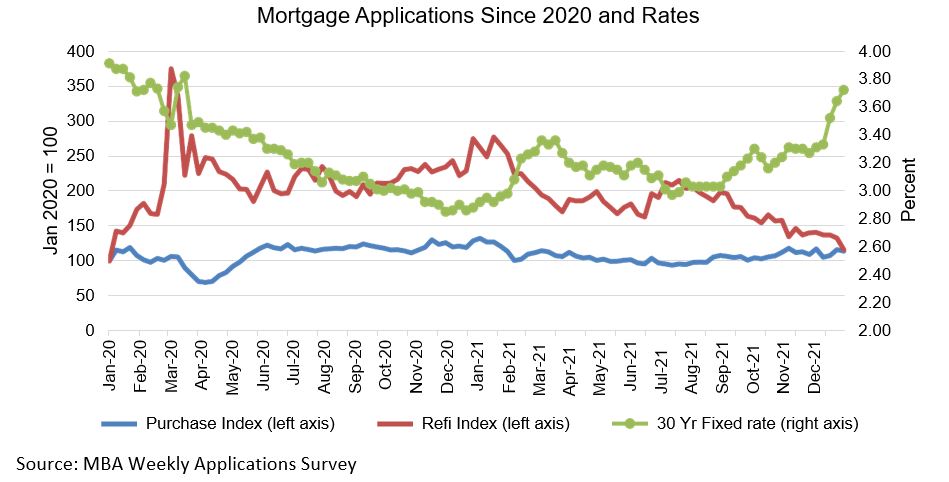

The catalyst of rate change can be attributed to persistent higher levels of inflation combined with the Fed’s messaging on contracting overall market liquidity under a tightening monetary policy stance. The MBA chart below outlines the fluctuation of rates over the past 2 years.

Key trends to note:

- The 30-year fixed rate has increased ~70 bps over last 6 months

- Refinance applications over the same time period have decreased ~37%

- Purchase volumes should remain steady as housing supply shores up and demand stays strong

The pace and direction of future rate changes may be influenced by the markets reactions to the rate of change in inflation, growth, and policy actions. In an uncertain and fluctuating market environment, organizations should be prepared to assess the agility of their business models to handle these uncertain and dynamic industry stresses.

Challenges to the Industry

While the rate changes are a factor to consider, the mortgage organizations will also see pressures from industry changes associated with returning to a pre-pandemic market. The contraction of the industry may cause challenges given these dynamics, presenting an opportunity for industry leaders to reassess their entire organization. The multitude of changes may test leaders in the mortgage industry with several aspects of their business model, including technology efficiencies, overhead, redundancies, processes, and more.

In order to combat these challenges and offset impact, companies can first review and assess their current end-to-end organizational design and operating model. Investments to make strategic enhancements in these areas will result in long-term efficiency gains. Achieving a dynamic business model without deteriorating margins involves a balance between major cross-cutting initiatives that yield larger results with less risky short-term projects, which result in quick calculated wins.

Questions to Consider in This Environment

As the industry begins a significant down-cycle, executives should prepare by asking themselves critical questions such as:

- What strategic options has the organization assessed and what would be required to implement each?

- What products or borrower segments can the organization leverage to compensate for declining volumes?

- Does technology efficiently and effectively support the existing business and is it flexible to enable desired change?

- Does the organization have a strategy in place that reflects its strategic position in the market?

- Is the organization defining its near and long-term objectives and prioritizing investments required to achieve them?

- How is the organization managing its costs as refinancing volumes decline?

Meet our Housing Finance Experts

Bill Beckmann

Bill has 40 years of experience in financial services focused primarily on mortgage banking operations and technology. Previous roles include:

- Senior Advisor at Housing and Urban Development

- Director and Committee Chair of non-profit, for-profit, and loan fund boards at Enterprise Community Partners

- CEO of Merscorp Holdings, Inc.

- CEO of CitiMortgage, Inc.

- CEO of The Student Loan Corp

Dave Stadler

Dave has over 40 years of experience in Financial Services with a broad background in operations and technology across financial services. Previous positions include:

- Mortgage CIO experience at Freddie Mac and GMAC/ResCap/Ally

- ~20 years at Accenture as a partner focused primarily on mortgage banking and technology

Dave Stevens

Dave is a 38-year veteran of Mortgage Banking. He has led a variety of teams both in the industry and in Washington. Previous roles include:

- President and CEO of MBA

- U.S. Asst. Secretary of Housing, Fed Housing Commissioner at HUD

- President and COO of Long & Foster Real Companies, Inc.

- Head of Single Family at Freddie Mac

- Head of Wholesale Lending at Wells Fargo

Jon Baymiller

Jon has 35+ years of experience in the residential mortgage industry. Previous roles include:

- President & CEO of New York Community Bank Mortgage Banking

- Advisory Board Member of Union Home Mortgage, Inc.

- Executive Vice President at AmTrust Bank

- Executive Vice President at CitiMortgage

- Executive Vice President and COO of Principal Residential Mortgage

Mike McPartland

Mike McPartland

Mike has 30+ years of experience in financial services with extensive experience leading teams in mergers and transformation initiatives across organizations. Previous roles include:

- MD at Citigroup

- Global Head of Residential Real Estate Lending

- North America Head, PB Lending

- US PB Fair Lending Officer

- MD at JPMorgan Chase

- US Residential Mortgage Product Head, PB and WM

Table of Contents

About Reference Point

Reference Point is a strategy, management, and technology consulting firm focused on delivering impactful solutions for the financial services industry. We combine proven experience and practical experience in a unique consulting model to give clients superior quality and superior value. Our engagements are led by former industry executives, supported by top-tier consultants. We partner with our clients to assess challenges and opportunities, create practical strategies, and implement new solutions to drive measurable value for them and their organizations.